HC Fire Network News CFIC2018 China Fire Safety Industry Conference registration registration began fire brand glory direct

(1) Industry development overview, competition pattern and marketization degree

1. Overview of the development of the industry

(1) Overview of the development of the fire protection industry

Fire safety is an important part of national public safety. The development level of the fire protection industry is an important indicator of the level of national economic and social development. The fire protection product manufacturing industry is the industry base for the fire protection industry. According to the "Compulsory Product Certification Implementation Rules" promulgated by the National Certification and Accreditation Administration on May 30, 2014, China's fire protection products can be divided into four major categories: fire-fighting equipment products, fire alarm products, fire protection products, and fire-fighting equipment products. Before the reform and opening up, China's fire protection industry developed slowly. The number of fire protection products manufacturers in the country is less than 100, and most of them are state-owned enterprises funded by the state. From 2001 to 2003, the state gradually abolished the registration and registration system for the production and sale of fire-fighting products, and gradually established a market access system for fire-fighting products. The environment of the fire-fighting market has undergone fundamental changes. Private enterprises have begun to get involved in the fire protection industry, and the industry has accelerated. With the growth of China's national economy, the fire protection industry has gradually developed. After more than ten years of development, there are more than 5,000 fire-fighting product manufacturers in China, and the overall size of the fire protection industry is large. There are a large number of enterprises in the fire protection industry, but there is a lack of industry leading enterprises. The market share of each enterprise is relatively scattered and the industry concentration is low. Most fire-fighting enterprises produce a single product type with low technical content. The product is highly homogenized in terms of appearance and function, and the gross profit margin is low. A few enterprises with technological advantages and brand advantages have high technical content and are intelligent. The automation function is strong, the gross profit margin is relatively high, and the growth is relatively fast. On a global scale, China's GDP has maintained a relatively fast growth rate in recent years, and the urbanization process has steadily advanced. As economic growth continues to invest in the construction of fire protection systems, the demand for fire protection products continues to expand. Governments at all levels have increased their emphasis on fire protection, the fire safety supervision system has been gradually improved, and the public safety awareness has created favorable conditions for the development of the fire protection industry. The fire protection industry is facing good development opportunities.

(2) Development of ultra-fine dry powder automatic fire extinguishing device

The ultra-fine dry powder automatic fire extinguishing device belongs to the fire extinguishing equipment product. The first dry powder fire extinguishing agent used in the fire protection industry was the sodium bicarbonate dry powder fire extinguishing agent developed in the United States in the 1930s. In 1968, China began to independently develop and produce dry powder fire extinguishing agent. Dry powder fire extinguishing agent is a kind of dry and fluid fine fine solid powder. It is mainly composed of one or more kinds of fine inorganic powders with fire extinguishing ability, moisture-proofing agent, anti-caking agent and flow promoter. The particle size and distribution are the key factors affecting the fire extinguishing effect. The development of dry powder fire extinguishing agent has experienced the first generation of sodium bicarbonate dry powder fire extinguishing agent, the second generation sodium bicarbonate dry powder fire extinguishing agent treated with magnesium stearate, and the third generation sodium bicarbonate treated by organosilicon silicidation. Salt dry powder fire extinguishing agent, potassium chloride dry powder fire extinguishing agent, sodium chloride dry powder fire extinguishing agent, ammonium phosphate dry powder fire extinguishing agent and ultrafine dry powder fire extinguishing agent. At present, dry powder fire extinguishing agents can be classified into three categories according to their application range - ABC class, BC class and D class. Ultrafine dry powder fire extinguishing agent is a kind of solid powder fire extinguishing agent with 90% particle size less than or equal to 20μm. The ultrafine dry powder fire extinguishing agent has large specific surface area and high activity, and can form a uniformly dispersed and relatively stable aerosol in air. The fire extinguishing efficiency is much higher than that of ordinary dry powder fire extinguishing agent. Ultra-fine dry powder is mostly ABC dry powder, suitable for fighting fires of Class A, B, C and live equipment, and has a wide application range. The ultra-fine dry powder fire extinguishing agent and its residue after fire extinguishing are stable in nature, no pollution to the protected substances, no corrosion, and easy to clean; the ozone depletion value of the ozone layer is zero, and the greenhouse effect potential value is zero. The ultra-fine dry powder automatic fire extinguishing device is a device that uses ultra-fine dry powder as the main fire-extinguishing particle to automatically start the fire extinguishing by means of temperature control or electric control. Some ultra-fine dry powder automatic fire extinguishing devices have dual control modes of temperature control and electric control, which can be automatically started when the ambient temperature reaches the threshold level, and can be used with manual buttons, fire detectors, fire alarm controllers and other components. The ultra-fine dry powder automatic fire extinguishing device not only has high fire extinguishing efficiency, but also has a fast fire extinguishing speed. The starting mode is instantaneous start, the injection is completed in a very short time, and the fire is extinguished. Because the ultra-fine dry powder automatic fire extinguishing device has the advantages of high fire extinguishing efficiency, low cost and environmental friendliness, it has been widely used in engine space such as automobiles, trains, airplanes, ships, etc., power distribution room, power station, wind power, nuclear power, motor room, etc. Space, storage space for solid materials such as wood, tobacco, cotton, paper, cloth, and fire protection in various places such as storage of oil chemical products.

2. Industry competition pattern and marketization degree

Since the Ministry of Public Security canceled the registration and registration system for the production and sale of fire products in 2001, the market access system for fire protection products has gradually improved, and the marketization of domestic fire protection products manufacturing has gradually increased, and the number of enterprises in the industry has grown rapidly. At present, the industry presents the following competitive landscape:

(1) Low market concentration

From the overall situation of the industry, the scale of China's fire protection products manufacturing enterprises is generally small, most SMEs lack brand recognition and technological advantages, and enterprise product sales rely on regional sales networks, fire engineering construction enterprises and other channels, and similar products. There are many competitors, sales are limited to the local market, and it is difficult to obtain a large market share, thus forming a market pattern with low overall concentration of the industry.

(2) The competition in the low-end market is fierce, and the leading companies in the professional, mid-to-high-end market have competitive advantages.

There are structural differences in the production capacity of fire protection products in China. In the general field and the low-end market, the product technology threshold is low, there are many production enterprises, and the production capacity is relatively surplus. Professional fields, high-end and high-end markets have high requirements for product functions and quality stability. Some areas also require enterprises to obtain relevant professional qualifications. For example, manufacturers of automobile engine compartment fire-fighting equipment must obtain IATF16949:2016 quality management system certification. The professional field, the middle and high-end market have high industry thresholds, and the number of qualified enterprises in the industry is small. Some enterprises with leading technology continuously improve the technical content and added value of products through independent research and development, thereby forming brand advantages and accumulating quality users.

(II) Industry technical level and industry characteristics

1. Industry technical level

China's fire protection industry has built the four fire protection research institutes of Tianjin, Shanghai, Shenyang and Sichuan under the Ministry of Public Security as the backbone, including university, enterprise and industrial sector research institutions, forming a fire scientific research system that communicates and cooperates with each other. Science, fire protection technology and fire protection soft science are the main directions of fire science and technology research. After years of development, China's fire protection products manufacturing industry has continuously improved its technical level and manufacturing capabilities, and has made great progress in fire alarm, automatic fire extinguishing, fire rescue and rescue. Among them, the automatic fire extinguishing device is mainly developed in the direction of multi-stage start-up, intelligentization, fire-fighting and efficiency improvement, and application in special fields.

2. Industry-specific business model

There is no unique business model for fire protection products manufacturing. However, different fire product manufacturers form different procurement, production and sales models according to their respective business types and downstream customer characteristics. In general, fire-fighting product manufacturing companies usually purchase the required raw materials according to sales forecasts and production plans, and adopt a production mode in which the production is fixed and the quantity is stocked. Enterprises with more dispersed customers in the downstream sector usually adopt a distribution-based sales model, and companies with relatively concentrated customers in the downstream sector usually adopt a direct sales-oriented sales model.

(3) Advantages and disadvantages affecting the development of the issuer

1. Favorable factors

(1) The level of urbanization and transportation and other supporting investments have been continuously improved, and the demand for fire protection has continued to drive. With the continuous improvement of China's urbanization level, the development of the fire protection industry has also ushered in an important opportunity.

In 2000, China's urban population was 459.06 million, and the urbanization rate was 36.22%. By 2016, the urban population reached 792.98 million, and the urbanization rate reached 57.35%. It is estimated that by 2025, China's urbanization level will exceed 60%. . The improvement of urbanization level has led to increased investment in urban transportation, urban construction, and urban underground integrated pipe corridors, which has steadily increased the investment in fire protection products and fire protection projects.

(2) Fire safety awareness is gradually improved, and fire protection gradually becomes an active demand

In recent years, with the development of social economy and the increase in the number of electrical appliances, the number of fires has increased significantly compared with the previous years, causing a lot of loss of life and property to society. At the same time, the fire safety responsibility system has been accelerated, fire protection and management efforts have been continuously increased, and the overall fire protection awareness of the society has gradually increased. People's requirements for fire safety and security are constantly improving, and the market demand for fire protection products is shifting from passive demand to active demand. End users are paying more and more attention to the quality of fire protection products and product performance requirements. The competitive advantages of fire protection products with brand advantages and market reputation are increasingly obvious.

(3) The order of the fire protection market is continuously regulated, and the business environment of the enterprise is continuously improved.

Since the special rectification of fire protection products was carried out nationwide in 2005, the fire protection industry supervision departments have continuously increased efforts to crack down on counterfeit and inferior fire protection products. In 2008, the company implemented ID card management for fire extinguishers and other fire products, effectively strengthening The supervision and management of fire protection products provides a good business environment for the development of regulated enterprises in the industry and promotes the healthy and sustainable development of the fire protection industry.

(4) Development of new energy vehicles to boost supporting fire safety requirements

The government's guidance and encouragement policy for new energy vehicles continued to be launched: The “Energy Conservation and New Energy Vehicle Industry Development Plan (2012-2020)†issued by the State Council pointed out that by 2020, the production capacity of pure electric vehicles and plug-in hybrid vehicles will reach 2 million vehicles, with cumulative production and sales exceeding 5 million.

In March 2015, the Ministry of Transport announced the “Implementation Opinions on Accelerating the Promotion and Application of New Energy Vehicles in the Transportation Industryâ€, clearly stating that by 2020, the proportion of new energy vehicles in urban public service vehicles should be no less than 30%. , the Beijing-Tianjin-Hebei region has a target of no less than 35%.

In November 2015, the Ministry of Transport, the Ministry of Finance, and the Ministry of Industry and Information Technology issued the “Measures for the Promotion and Application of New Energy Buses (Trial)â€, requiring Beijing, Shanghai, Tianjin, Hebei, Shanxi, Jiangsu, Zhejiang, Shandong, and Guangdong. Hainan, the proportion of new energy buses in new and replaced buses in 2015-2019 should reach 40%, 50%, 60%, 70% and 80% respectively, Anhui, Jiangxi, Henan, Hubei, Hunan, Fujian, The proportion of new energy buses in new and replaced buses in 2015-2019 should reach 25%, 35%, 45%, 55% and 65% respectively. Other provinces (autonomous regions and municipalities) added and replaced in 2015-2019. The proportion of new energy buses in buses should reach 10%, 15%, 20%, 25% and 30% respectively.

In February 2016, the State Council announced that the proportion of new energy vehicles purchased by central government agencies, government agencies and public institutions for the promotion and application of new energy vehicles accounted for the proportion of new vehicles in the year, from 30% to 50%.

In September 2017, the Fujian Provincial New Energy Automobile Industry Development Plan (2017-2020) issued by the People's Government of Fujian Province pointed out that by 2020, the province's new energy vehicle production capacity will reach 300,000 units, and the new energy vehicle industry chain will be realized. The output value has exceeded 180 billion yuan; a group of new energy vehicle and component leading enterprises with independent core intellectual property rights, strong core competitiveness, leading position in the country and international competitiveness; supporting Xiamen Guoanda Power Battery Safety System and other power battery and safety system production enterprise development and project construction. Policy encouragement and environmental protection demand will be expected to promote the development of new energy vehicle market, and gradually apply new energy vehicles in urban public transportation, intercity passenger transportation, logistics and distribution, corporate and private travel, etc., corresponding to the safety needs of transportation, especially large capacity. As a safety emergency requirement for the power system, lithium batteries will drive the market demand for automatic fire extinguishing devices for battery boxes.

2. Unfavorable factors

(1) Insufficient investment in R&D in the industry, insufficient capacity for independent innovation

The technical level needs to be improved. There are few scientific research institutions in China's fire protection industry, few scientific research personnel, insufficient scientific research investment, lack of multi-disciplinary compound talents, insufficient scientific and technological innovation ability, lack of innovative product development work, and adversely affect the sustainable development of the industry. .

(2) Industry concentration is low, competition is fierce, and development is still not standardized

In recent years, in the context of the steady and rapid development of China's national economy, the fire protection industry has also achieved rapid development. However, the scale of fire protection enterprises in China is generally small, the industry is fiercely competitive, and the industry lacks the founders and leaders of market order. In the case of small enterprise scale, low credit rating, poor financing ability and weak anti-risk ability, fire-fighting enterprises are unable to carry out sufficient information collection and technology development, and it is difficult to rapidly improve product quality, technical content and competitiveness.

(4) The correlation between the industry and the upstream and downstream industries and the impact of the upstream and downstream industries on the development of the industry

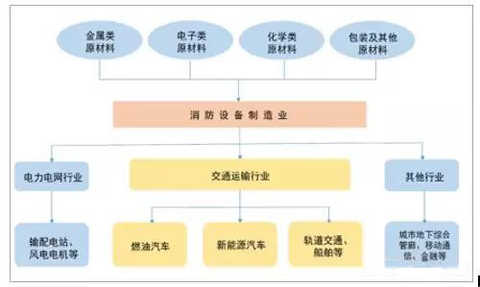

The upstream of the industry is mainly for the production of metal raw materials such as cold-rolled steel sheets, electronic raw materials such as wire harnesses, and various chemical fire extinguishing agent raw materials. The downstream is mainly the fire protection application industries such as transportation, power grid, wind power, and urban underground integrated pipe gallery. The upstream and downstream relationship of the industry is as follows:

Source of data: public information

The upstream industry is mature in technology, the market is competitive, the supply of raw materials is sufficient, and the prices of products are stable, which has little impact on the development of the fire protection products industry. The downstream industry determines the market capacity. With the continuous improvement of urbanization level and supporting investment in transportation and energy, it will drive the growth of relevant professional fire protection demand.

Especially for the transportation industry, the fire protection needs of downstream subdivision applications are in a period of rapid growth:

1. The scale of the new energy vehicle market continues to grow rapidly

At the same time, China has successively issued a number of national policies and industry standards, and made clear requirements for the necessity of installing automatic fire extinguishing devices for battery boxes in new energy vehicles, which will continue to drive the demand for fire protection products for new energy vehicles to continue to grow;

2. The fire protection demand in the passenger car market is still growing.

According to the requirements of the national compulsory standards, from January 1st, 2018, the engine compartment, battery compartment and other parts of the passenger cars that require more than 9 seats should be equipped with ultra-fine dry powder automatic fire extinguishing devices, which will greatly increase the demand for fire protection;

3. The automatic fire extinguishing device is expanding in the subdivision application field of the transportation industry.

With the increasing demand for public safety emergency products, professional fire protection requirements in the transportation sector such as rail transit and ships are gradually increasing.

4. Smart fire promotes the transition from passive fire to active fire

Mobile terminals and mobile apps will play an important role in smart fire protection applications. UFC technology, video surveillance technology, fire protection, intelligent maintenance and other functions can be used for rapid data collection and automatic process recording of objects and events involved in fire management. The popularization and application of mobile APP will further expand the fire control means, such as the track check of fire law enforcement, the record of fire inspection process, the maintenance and inspection of fire protection facilities, etc., which can effectively guarantee the data quality. The application of mobile APP will make the business application based on smart fire protection more convenient and efficient.

Through the Internet, big data, intelligent fire protection, promote the transformation of fire supervision and management to fire safety management, promote the transition from passive fire to active fire, promote the transformation of fire drive to risk drive; and finally realize the transformation from traditional fire to modern fire.

Wisdom fire protection is an inevitable trend of urban fire protection construction. Smart fire protection construction conforms to the construction trend of smart cities and is an important part of smart city and fire information construction. As a new thing, it must have its development connotation and requirements.

Editor in charge: Li Pengyan

Roller Blind Curtain Shade Fabric

Fabric for choice: roller, zebra, shangri-la, and can dyed colors, printed the photos, jacquard the design you like, refer the actual sample.

Suitable for use in private houses, offices, factories, hotels and other places. Shade roller is a beautiful protective device, shading effect and privacy are very good, anti-ultraviolet, keep indoor air smooth. The exquisite jacquard pattern is more layered and changeable, with smooth surface, silky luster, smooth and delicate, soft and breathable.

Roller Blind Blackout,Bathroom Roller Blinds,Blinds Roller Shades Office Curtain,Roller Blind Curtain Shade Fabric

SHAOXING JEVA IMP.&EXP CO., LTD. , https://www.sxcurtain.com